Worried About a Housing Crash? Don’t Be!

You know the whole thing about history repeating itself? Well, in this case, that saying does not apply to the housing market. We’re sure you remember the housing crash in 2008 as well as the Great Recession. Those times were worrisome (rightfully so), but as with most things in life, we learned some valuable lessons. Here are a few reasons to not be concerned about another housing crash.

You know the whole thing about history repeating itself? Well, in this case, that saying does not apply to the housing market. We’re sure you remember the housing crash in 2008 as well as the Great Recession. Those times were worrisome (rightfully so), but as with most things in life, we learned some valuable lessons. Here are a few reasons to not be concerned about another housing crash.

Will There Be Another Housing Crash?

There’s no doubt about it that the past two years created one crazy ride in the real estate market. Not only were refinances at a serious high, but buying a home was also off the hook. Since then, there have been concerns such as low inventory and increased interest rates. But if you look back in time, mortgage interest rates in the ’80s were approximately 20%. That’s a lot of interest right there.

Whether you’re an agent, a lender, homebuyer, home seller, refinancer, etc., we understand the concerns. Take solace in the fact that the housing market today is nothing like it was back in 2008. As serious as it was then, we did come out learning what not to do with the real estate market.

What’s Different This Time?

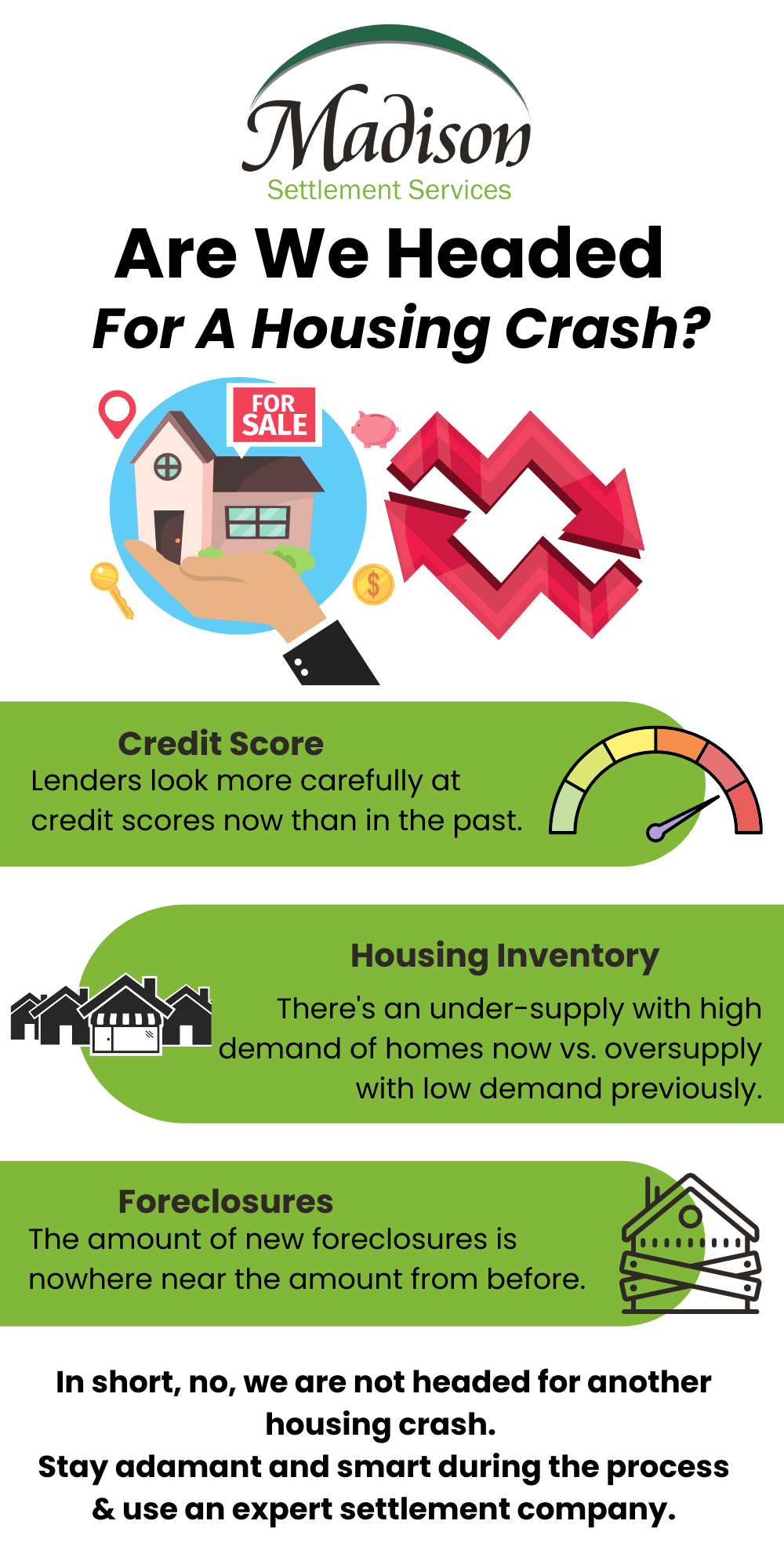

Years ago, people got away with getting a mortgage loan with a low credit score. Lenders then were not as particular about loans if your credit was on the lower end. Flash forward to today where lenders are more careful. If you currently have low credit, some of our favorite tips include: paying credit card statements off in full monthly, keeping your credit usage down, and trying to limit your requests for new credit.

Home Inventory

During the housing crash in 2008, home inventory was in oversupply with little demand. Meanwhile, today, the housing market is experiencing an under-supply with high demand. While low inventory is not the fuzziest feeling to read about or deal with, it’s certainly a more positive outlook for the economy in general. If you’re looking to buy or sell your home, make sure you work with a real estate professional!

Foreclosures Are Different Now

Foreclosures many years ago were in the millions. But that situation today is very different. Over the past four years, new foreclosures have been roughly under 300,000. That’s a big jump in numbers!

Final Thoughts & Advice

As the housing industry continues to evolve, there is no need for fears of another housing crash.

Our best advice to home buyers and sellers? Stay adamant, don’t give up, realize that a home is the best investment you can make for your future, and work with a wonderful agent and lender. Also don’t forget to purchase title insurance. This market is still crazy and hot, but you never know what issues might happen once the paperwork is done. Title insurance protects you, don’t neglect it!

And our best advice to agents and lenders? Keep up the awesome work. Stay constantly in the know of the market. And work on ways to expand your business via marketing tools and strategies. If you need a title/settlement team that’s got your back from start to finish, connect with the experts at Madison Settlement Services today.